Keeping your business finances in order can feel overwhelming—especially when you’re wearing multiple hats as a small business owner. Outsourcing bookkeeping can free you to focus on growing your business while professionals handle the numbers. This guide walks through what outsourced bookkeeping looks like, the benefits, when to consider it, and how to pick the right partner. By the end, you’ll be able to decide whether outsourcing makes sense for your business.

Here’s what we’ll cover: what outsourced bookkeeping is and how it works, the main benefits, signs it’s time to outsource, how to choose a partner, typical costs and pricing models, and a side-by-side look at outsourced vs. in-house bookkeeping.

What Is Outsourced Bookkeeping and How Does It Work?

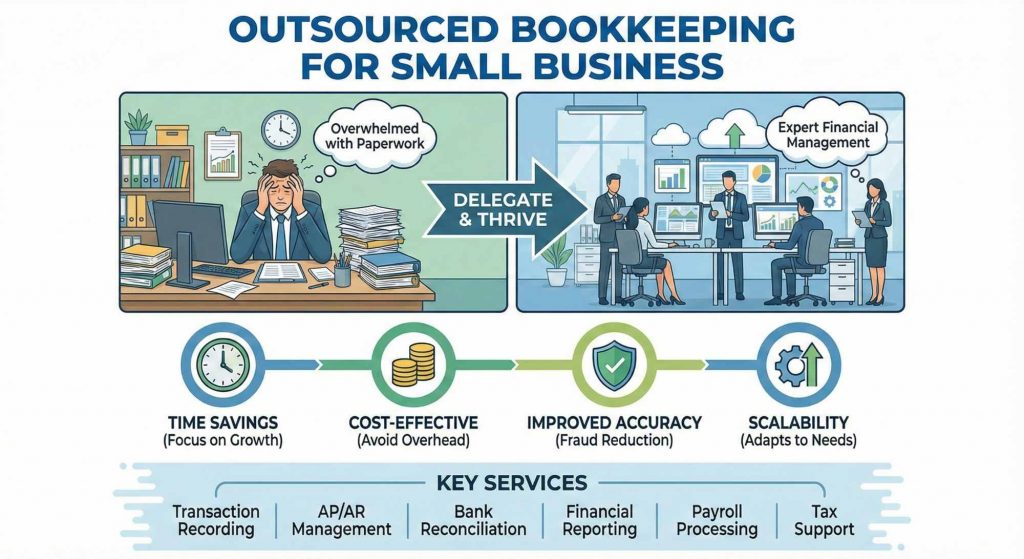

Outsourced bookkeeping means hiring an external team or firm to manage your financial records and transactions. Instead of handling day-to-day bookkeeping in-house, you delegate those tasks to specialists who keep your books accurate and up to date. Services range from basic data entry to detailed financial reporting and analysis.

What Are the Types of Outsourced Bookkeeping Services?

Outsourced bookkeeping comes in a few common flavors, including:

- Virtual Bookkeeping: Access your books online with real-time updates and easy collaboration with your bookkeeping team.

- Full-Service Bookkeeping: End-to-end bookkeeping—accounts payable, accounts receivable, payroll, and reporting—handled for you.

- Specialized Services: Industry-specific bookkeeping, tax prep, or financial consulting tailored to your business’s needs.

How Do Virtual Bookkeeping and Cloud-Based Systems Facilitate Outsourcing?

Cloud tools and virtual bookkeeping make outsourcing practical and secure. Key benefits include:

- Accessibility: View and share financial records from anywhere, improving collaboration with your bookkeeper.

- Real-Time Updates: Cloud systems keep your data current so decisions are based on accurate numbers.

- Data Security: Modern platforms include strong security controls to protect sensitive information.

What Are the Key Benefits of Outsourcing Your Bookkeeping?

Outsourcing bookkeeping can improve your business’s efficiency and free up time for growth. The top advantages include:

- Cost Savings: Outsourcing often costs less than hiring a full-time employee once you factor in salary, benefits, and overhead.

- Time Efficiency: Hand off routine tasks so you can focus on strategy, sales, and operations.

- Access to Expertise: Outsourced teams bring experience and stay current with rules and best practices.

For small business owners, partnering with a dependable team—like Moxie Business Assist—can simplify financial management and let you concentrate on your goals.

How Does Outsourcing Save Costs Compared to In-House Bookkeeping?

Outsourcing can reduce several recurring expenses:

- Salaries and Benefits: No full-time payroll burden for a dedicated bookkeeper.

- Training and Development: Outsourced providers supply trained staff, removing the need for ongoing training costs.

- Software and Technology: Many providers use cloud accounting tools, lowering your investment in expensive software.

Most businesses rely on specialized accounting software for day-to-day tracking. Proper management of those systems is key to accurate records and smooth financial operations.

How Can Outsourcing Help You Reclaim Time and Reduce Stress?

Delegating bookkeeping eases the burden of day-to-day financial work. Typical gains include:

- Focus on Core Activities: With bookkeeping handled, you can spend more time on growth, customers, and strategy.

- Reduced Workload: Less juggling of administrative tasks helps prevent burnout and keeps priorities clear.

When Is the Right Time to Outsource Your Bookkeeping?

Knowing when to outsource is a practical decision tied to your business’s stage and needs. Look for these signs.

What Business Growth Signs Indicate Outsourcing Is Needed?

- Rapid Growth: Scaling up often means bookkeeping demands outpace your internal capacity.

- Increased Transaction Volume: More sales, invoices, and payments make manual bookkeeping time-consuming and error-prone.

- Complex Financial Needs: As your operations grow, specialized services become necessary.

How Do Expertise Gaps and Compliance Concerns Influence Outsourcing Decisions?

Compliance and skill gaps often push owners toward outsourcing. Key points to consider:

- Compliance Risks: Noncompliance can be costly. Professional bookkeepers know regulatory requirements and help you avoid penalties.

- Lack of In-House Expertise: If your team doesn’t have the financial skillset you need, outsourcing brings those capabilities on day one.

How Do You Choose the Best Outsourced Bookkeeping Partner?

Picking the right bookkeeping partner matters. Consider these selection criteria.

What Industry Experience and Service Range Should You Look For?

When evaluating providers, pay attention to:

- Relevant Experience: Providers familiar with your industry will better understand your specific workflows and reporting needs.

- Service Offerings: Make sure they offer the services you need now—and can scale as your business grows.

Why Are Communication and Security Protocols Critical in Selection?

Strong communication and security are non-negotiable. Focus on:

- Communication Frequency: Agree on how often you’ll receive updates and who your day-to-day contact will be.

- Data Security Measures: Confirm their protocols for encryption, access control, backups, and compliance.

What Are the Typical Costs and Pricing Models for Outsourced Bookkeeping?

Knowing common pricing approaches helps you budget and compare providers.

What Factors Influence the Cost to Outsource Bookkeeping?

Costs usually depend on:

- Transaction Volume: More transactions mean more time and higher fees.

- Service Complexity: Tasks like tax prep, payroll, or advisory work add to the cost.

How Does Moxie Business Assist Offer Transparent Pricing and Custom Quotes?

Moxie Business Assist provides clear pricing and custom quotes based on your needs. That way you only pay for the services you use, making budgeting straightforward and predictable.

How Does Outsourced Bookkeeping Compare to In-House Bookkeeping?

Comparing outsourced and in-house bookkeeping helps you weigh control versus cost and flexibility.

What Are the Advantages and Disadvantages of Outsourced vs. In-House Bookkeeping?

Outsourced bookkeeping brings cost savings, flexibility, and expertise, though it may mean less day-to-day control. In-house bookkeeping offers immediate oversight but can carry higher payroll and training costs.

How Does Outsourcing Provide Scalability and Flexibility for Small Businesses?

Outsourcing lets small businesses scale their financial support up or down—use more help during busy seasons and scale back when things slow—so you always have the right level of service for your current needs. If you need higher-level guidance, you can layer on CFO services as well.

| Service Type | Description | Benefits |

|---|---|---|

| Virtual Bookkeeping | Online access to financial records | Real-time updates, accessibility |

| Full-Service Bookkeeping | Comprehensive financial management | Cost-effective, time-saving |

| Specialized Services | Tailored bookkeeping solutions | Expertise in specific industries |

This table summarizes common outsourced bookkeeping options and the benefits each delivers, so you can choose the right fit for your business.

Outsourcing your bookkeeping can be a strategic move that streamlines operations and frees you to focus on growth. Understand the benefits, watch for the right timing, and choose a partner who fits your business—and you’ll be set up for better financial clarity and less day-to-day stress.

Frequently Asked Questions

What should I consider when evaluating potential bookkeeping partners?

Look at industry experience, the services they offer, and client feedback. Providers who’ve worked with businesses like yours will understand the nuances of your finances. Check their service scope to ensure they cover what you need, and read testimonials or case studies to confirm reliability and results.

How can I ensure the security of my financial data when outsourcing?

Ask about encryption, access controls, routine security audits, and data backup practices. Confirm compliance with applicable regulations and get clear documentation on how they protect client data. A trustworthy provider will be transparent about security measures.

What are the common pitfalls to avoid when outsourcing bookkeeping?

Avoid unclear expectations, skipping credential checks, or failing to set regular reviews. Spell out responsibilities up front, verify qualifications and references, and schedule consistent check-ins to catch and fix issues early.

How can I measure the success of my outsourced bookkeeping?

Track KPIs like report accuracy, on-time deliverables, and responsiveness. Also measure business impact—did outsourcing free up time for growth or improve decision-making? Regular feedback meetings will help you fine-tune the relationship.

What should I do if I am unhappy with my outsourced bookkeeping service?

Start by discussing specific concerns with your provider and request a plan to address them. If issues persist, review your contract, look for termination terms, and identify alternate providers so you can transition with minimal disruption.

Can outsourcing bookkeeping help with tax preparation?

Yes. Professional bookkeepers often prepare clean, organized records that make tax filing smoother and more accurate. They can also spot deductions and ensure records comply with tax rules, which can save time and reduce errors during tax season.

Conclusion

Outsourcing bookkeeping can boost efficiency, cut costs, and give you back the time to focus on growing your business. With the right partner, you get reliable reporting, compliance support, and flexible service levels that match your needs. If you’re ready to simplify your finances, explore our tailored bookkeeping solutions and let us help you take the next step toward clearer, calmer financial management.